Asset Management

SUN Group’s private investment arm has sponsored private equity funds, venture funds and also invested directly in private equity and venture opportunities on a transaction-by-transaction basis. Across its investment vehicles in private equity, venture capital, and real estate, the group has raised and managed over US$8bn in assets, with contributions from global institutional investors and family offices.

Private Equity

In 1992, SUN Group started SUN Brewing, Russia’s first consolidation play in the food and beverage sector. SUN Brewing ended 1993 with about US$ 30 million in annual sales. SUN consolidated a number of breweries, malt plants and soft drinks bottlers, bottling both Coca-Cola and Pepsi-Cola in different facilities around Russia and Ukraine. SUN restructured and grew the business to a market value of about US$ 4 billion over 12 years. SUN Brewing became the first company in the food and beverage sector in the region to be listed on a foreign stock exchange.

In 1999, SUN Brewing partnered with Interbrew from Belgium and by 2004, SUN InterBrew was the 12th largest brewing company in the world, when SUN sold its stake in SUN Interbrew to AB InBev for cash and shares.

Harvard Business School published two case studies on the Khemka family’s experiences founding and growing SUN Brewing and SUN InterBrew. The businesses are showcased as examples of cross-border enterprise creation in emerging markets.

Technology

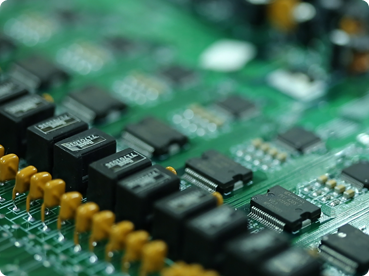

SUN has been an investor in global venture capital since the mid 1990s, and had several early successes in companies such as Amazon and JustGiving.

SUN sponsored and helped establish one of India’s first venture capital funds Westbridge Capital, which became a leading player in the emerging Indian high technology landscape. The fund capitalised on growth opportunities in the early phase of the Information Technology boom in India, specifically targeting value creation in IT, Consumer Internet, and Specialised Outsourced services.

Westbridge partnered in 2006 with Sequoia Capital, one of the world’s leading venture capital firms, which was subsequently rebranded Sequoia Capital India.

Real Estate

In 2006, SUN and Apollo co-sponsored one of India’s largest private equity funds for real estate. This was, at the time, India’s largest sector-specific fund raised for any sector in the alternative asset management space.

The fund made Investments across a wide segment of real estate – global IT parks, malls, luxury residential apartments, affordable housing, and commercial retail spaces.

The anchor investors for the fund included top-tier U.S. pension funds, Middle East sovereign institutions and U.S. corporate pension funds.